3.which of the Following Accounts Are Debited to Record Increases

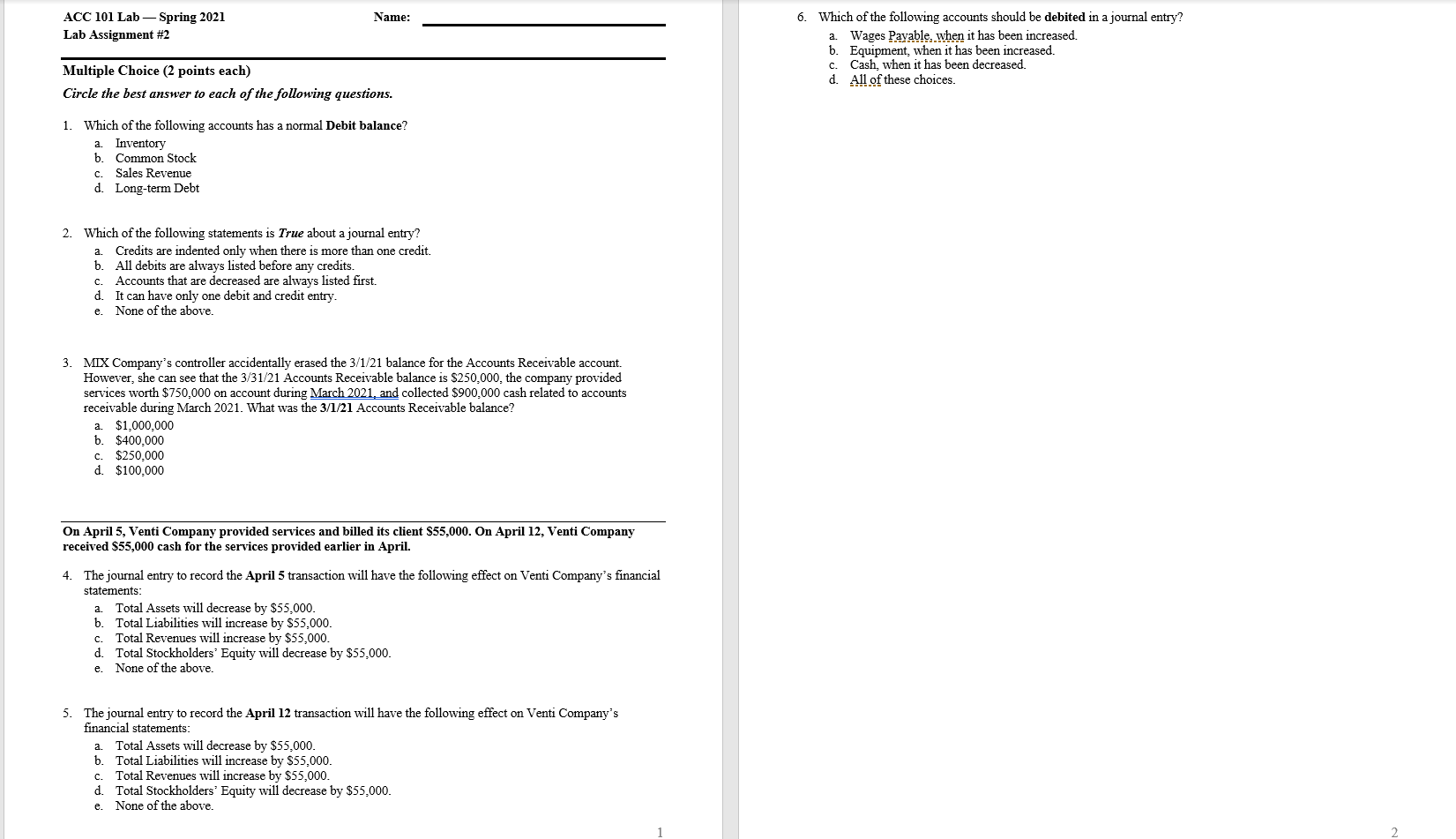

Which of the following accounts increases with a debit. Drawing Question 6 of 20 50 Points Which of the following types of accounts normally have debit balances.

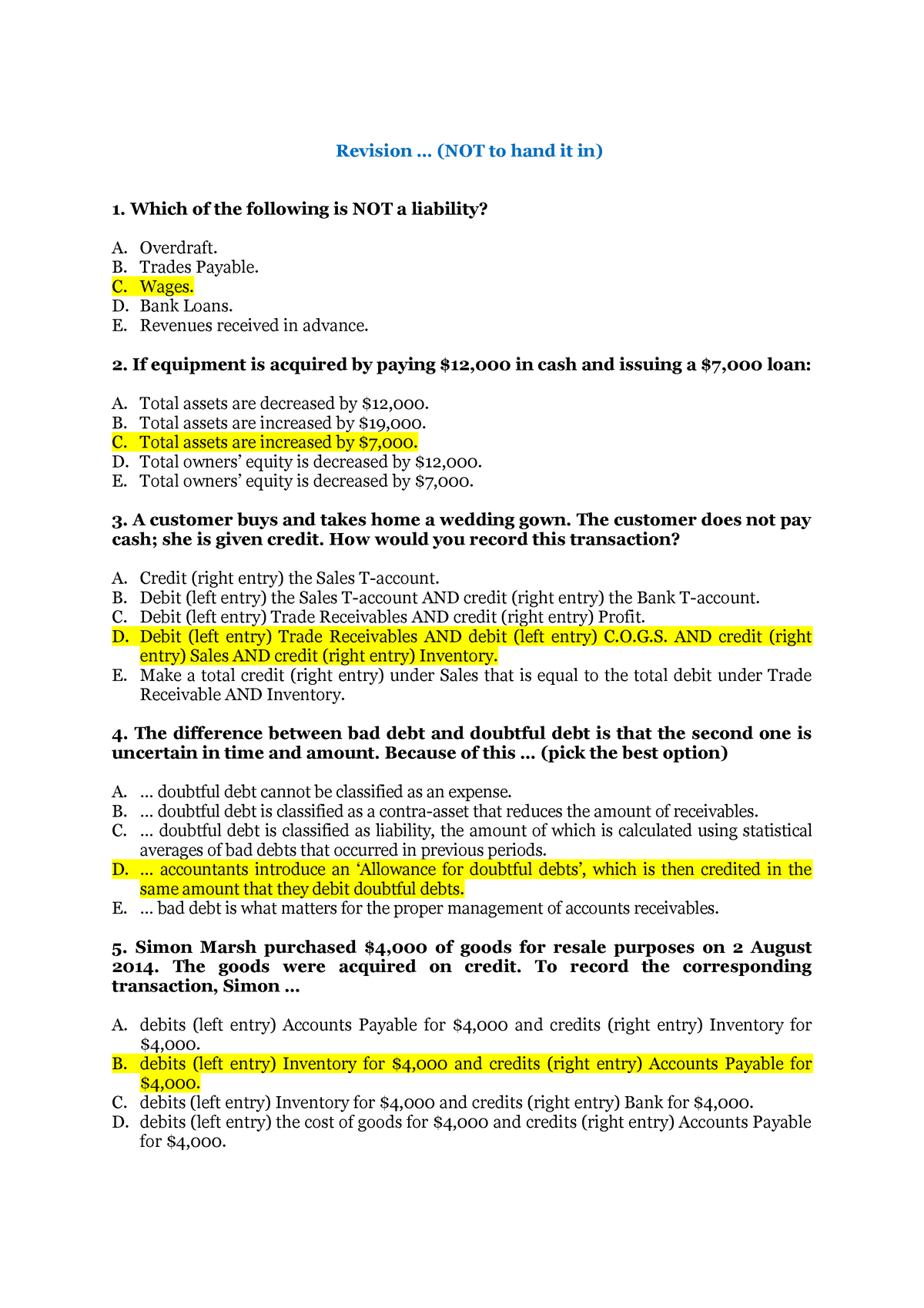

Accounting Principles 12th Edition Ch2

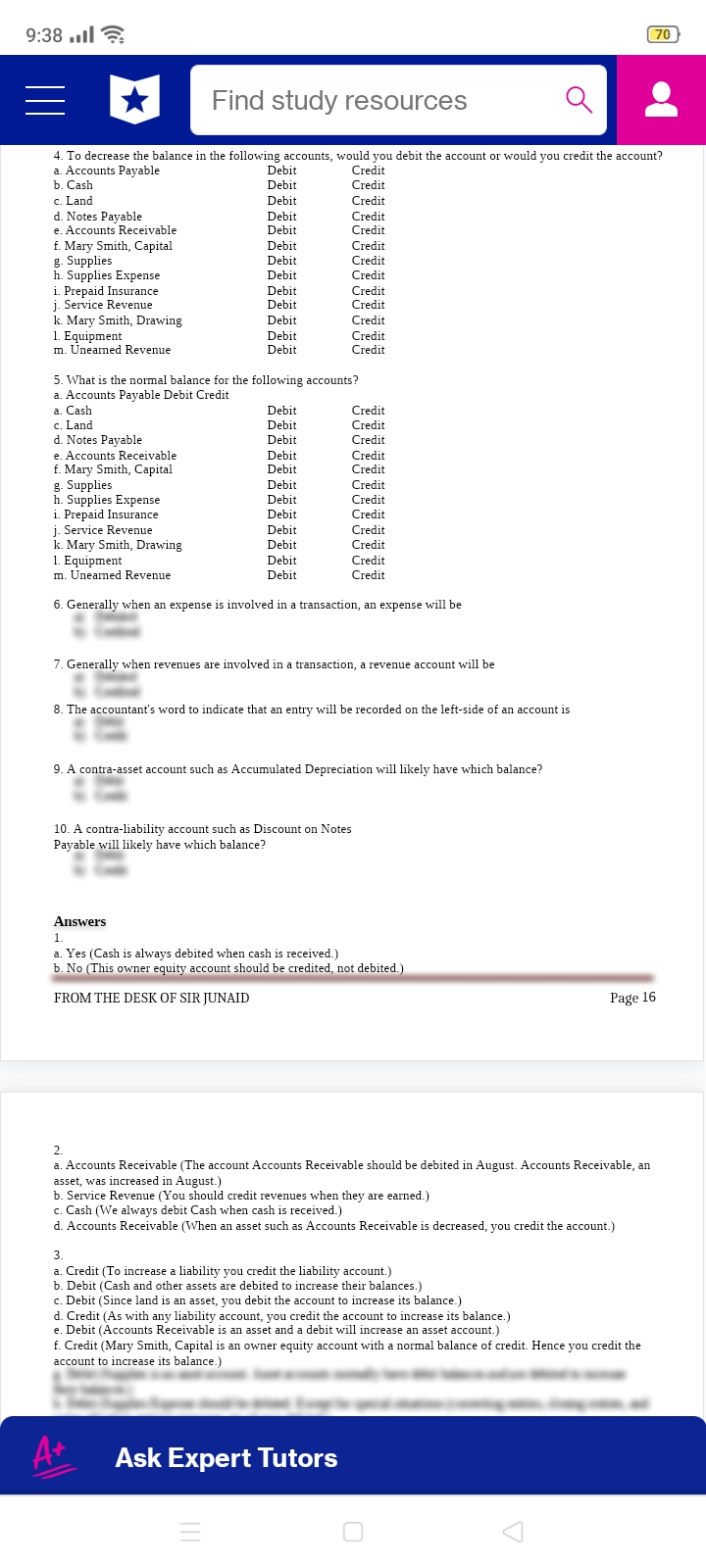

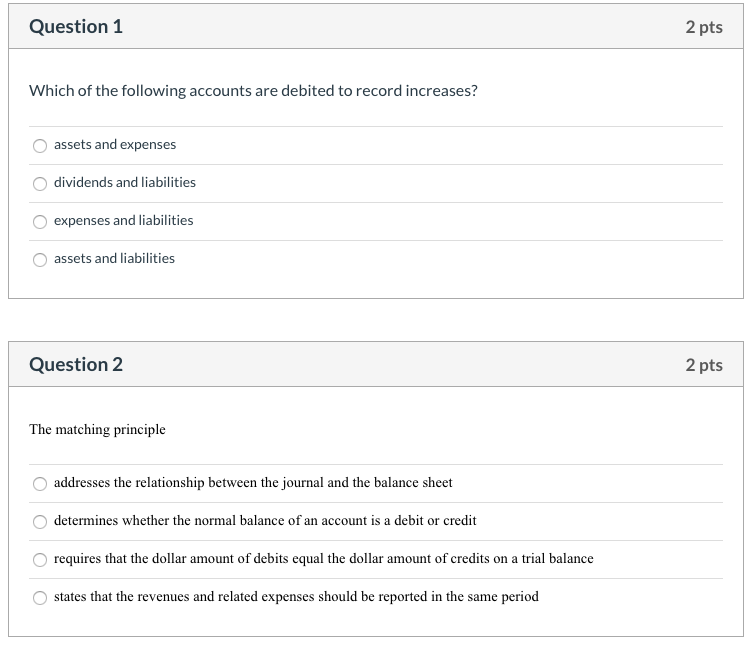

Which of the following accounts are debited to record increases.

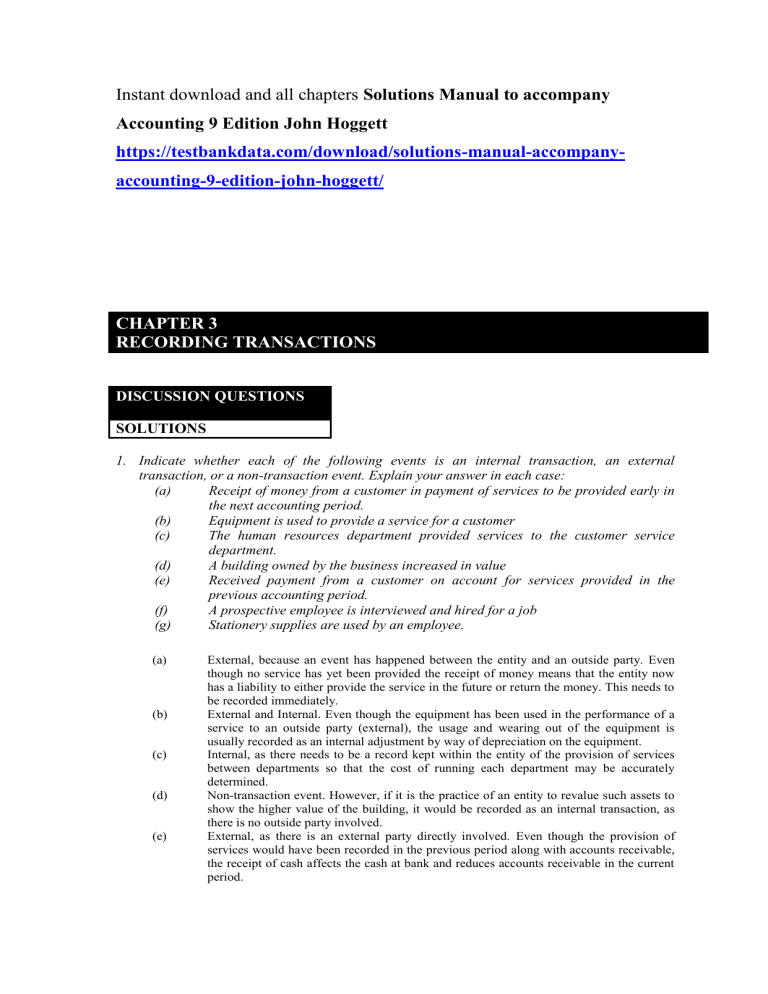

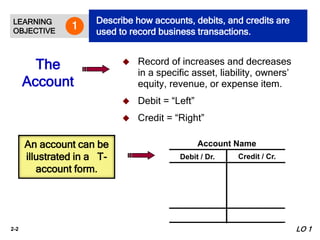

. An account is an individual accounting record of increases and decreases in specific assets liability and stockholders equity items. A _____ debitcredit to the Accounts receivable account and a _____ debitcredit to the Service revenue account. Purchased a 10000 truck on credit 2.

Debit Accounts Receivable and credit Cash. Assets and liabilities B. Up to 25 cash back Accounting 1.

Complete the following table. Debits increase account balances in the assets section and decrease account balances in the liabilities and equity sections. Matching debit and credit terminology with accounting elements LO 3 1 Required.

The client paid 100 immediately but promised to pay the balance next month. A Expenses increase equity so an expense accounts normal balance is a debit balance. Machinery Real Account Cash Real Account Singhania Personal Account Effect of Transaction.

Table 35 Problem 10EA. The journal entry to record this transaction in Callie Companys books would include a _____ debitcredit to the Cash account. If they are paid after they are incurred.

Question 3 A firm paid cash to apply against a debt. There are separate accounts for specific assets and liabilities but only one account for stockholders equity items. A sample is provided.

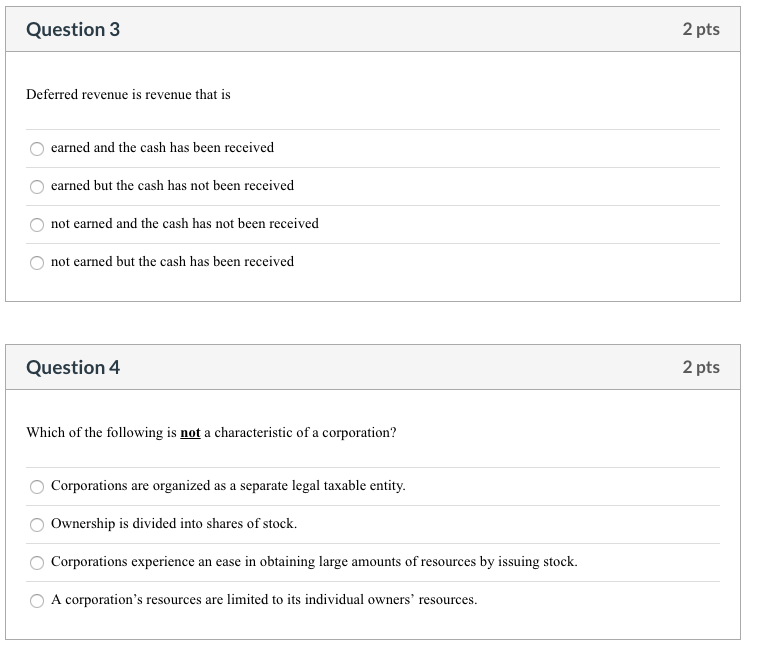

D Expenses decrease equity so an expense accounts normal balance is a credit balance. Up to 25 cash back Question 5 of 20 50 Points The account used to record increases in owners equity from the sale of goods or services is the _____ account. Expenses and liabilities D.

Table 34 Problem 8EA. For the following accounts please indicate whether the normal balance is a debit or a credit. A decreases in assets and owners equity and increases i.

Accounting basis in which companies record transactions that change a companys financial statements when those events occur rather than in the periods in which the company receives or pays cash. Machinery asset increases by Rs 200000 Cash asset decreases by Rs 30000 and Creditors liability increases by Rs 170000. Complete the following table by indicating whether a debit or credit is used to increase or decrease the balance of accounts belonging to each category of financial statement elements.

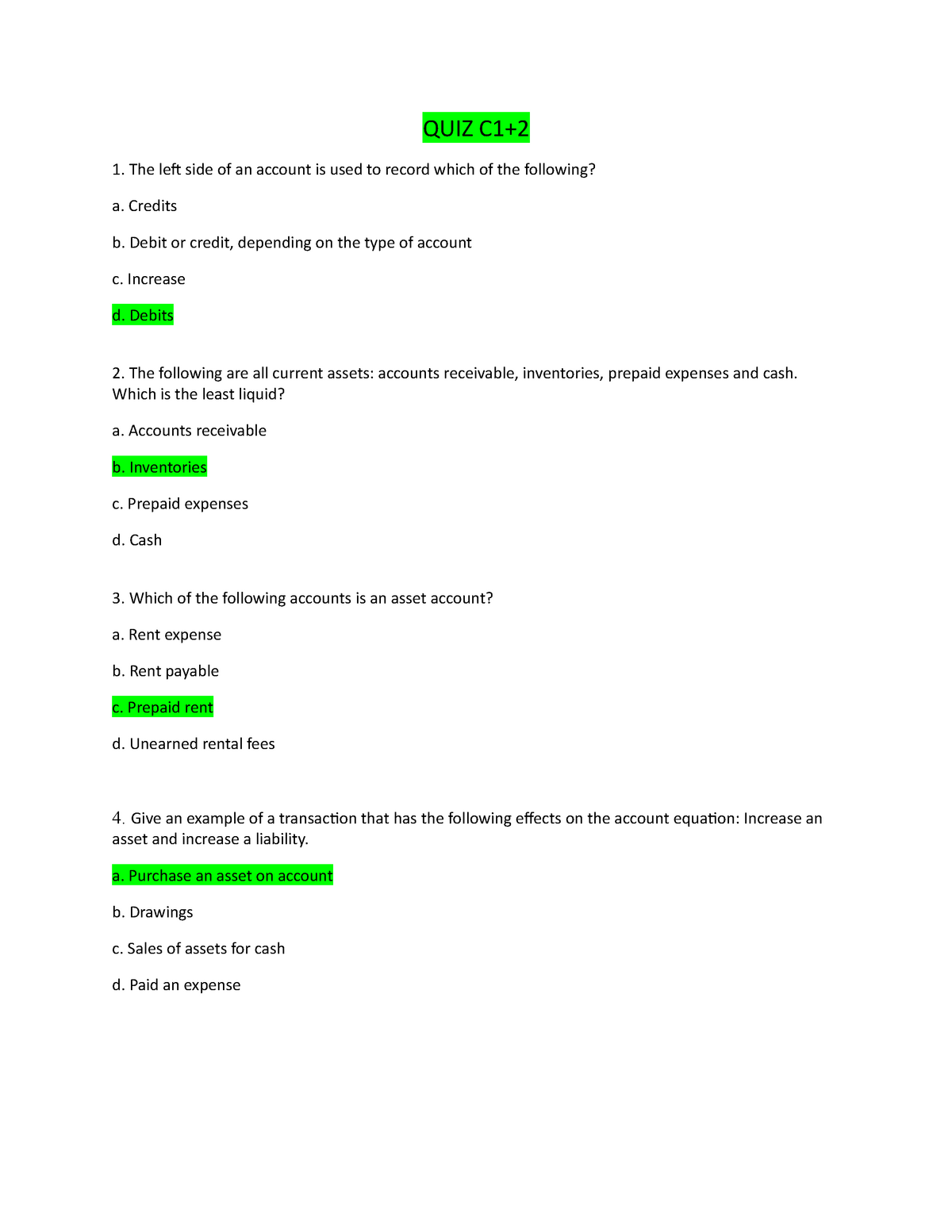

In which of the following types of accounts are increases recorded by credits. A The right side of an account is the debit or increase side. The word debit means to increase and the word credit means to decrease.

For each of the T-accounts indicate the side of the account that should be used to record an increase or decrease in the financial statement element. C There are separate accounts for specific assets and liabilities but only one account for stockholders equity items. The cash account is debited as it increases the asset of the company unearned service revenue account debited because of a decrease in liability and service revenue account being a counter account is credited because of increase in income of the company.

For each account listed on the left fill in what category it belongs to whether increases and decreases in the account are marked on the debit or credit sides and on which financial statement the account appears. Question 4 When revenue is earned from charge-account sales the. ACash bInterests Payable cAccounts Receivable dSmith Capital.

Borrowed 5000 cash from the bank 3. When they are incurred and paid at the same time. 12 Every business transaction is recorded by a debit to a balance sheet account and a credit to an income statement account.

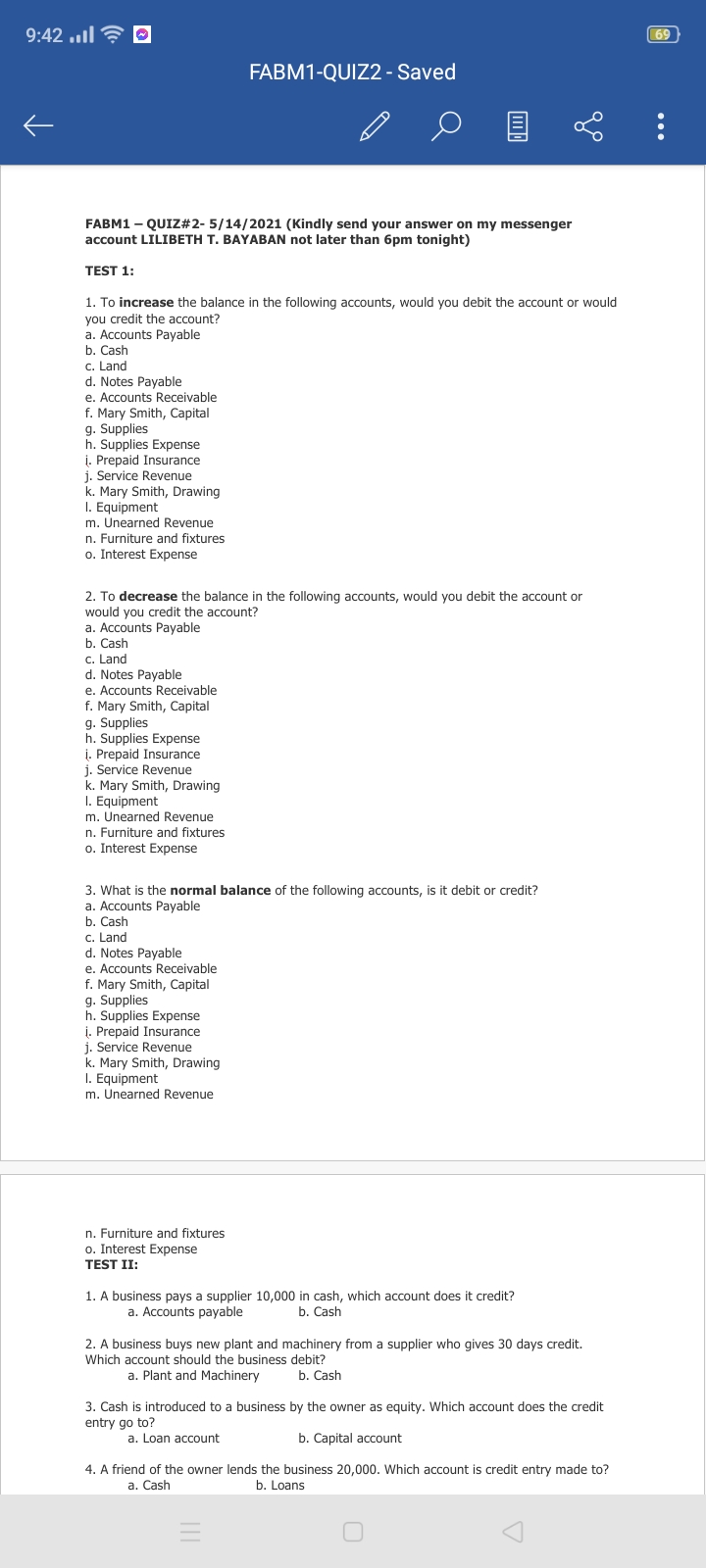

11Which of the following accounts are debited to record increase in balances. 1 ACC 2013 Chapter 3 In Class Exercises EXERCISE 3 1A. Indicate what impact the following transactions would have on the accounting equation.

Dividends and liabilities C. The ending balance for an asset account will be a debit. Debits and credits affect account balances in the following way.

Assets and liabilities Oc. Debit asset up credit asset down. 11 If the number of debit entries in an account is greater than the number of credit entries the account will have a debit balance.

Credits are used to record. The left side of an account is the credit or decrease side. Increases in assets and expenses are debit entries and increase the liabilities equality and revenue are credit entries.

Assets and expenses Od. Expenses and liabilities Ob. Of the following accounts are debited to record increase in balances.

The right side of an account is the debit or increase side. Credit Cash and credit Accounts Payable. Assets Liabilities Equity Debit inc Credit dec Debit dec Credit inc Debit dec Credit inc 1.

Debit Accounts Payable and credit Cash. Record the debit and credit for each of the following transactions transaction 1 is done for you. Asset increases are recorded with a debit.

The left side of an account is always the debit side and the right side is always the credit side. Adrawing and liabilities bassets and expenses cexpenses and liabilities dassets and liabilities. 13 When making a general journal entry there can only be one debit and one credit.

Debits are used to record increases in. C Expenses increase equity so an expense accounts normal balance is a credit balance. Identify the normal balance for each of the following accounts.

Asset accounts especially cash are constantly moving up and down with debits and credits. Increases and decreases of the same account are common with assets. First step to memorize.

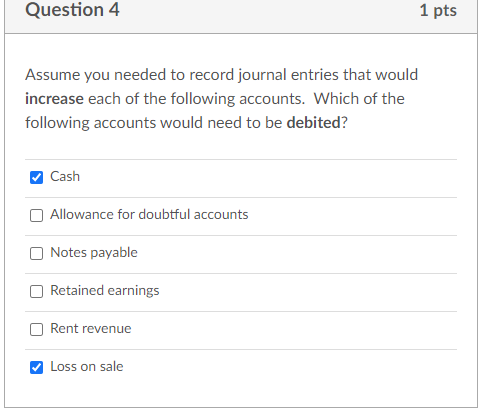

Accounting questions and answers. 62 CHAPTER TWO The Accounting Process CP 23 Required. MC02-109 Which of the following accounts are debited to record increases.

To record this transaction the accountant would. B Expenses decrease equity so an expense accounts normal balance is a debit balance. Debit Cash and credit Accounts Payable.

The account used to record increases in owners equity from the sale of goods or services is A. B An account is an individual accounting record of increases and decreases in specific assets liability and stockholders equity items.

Solved Question 1 2 Pts Which Of The Following Accounts Are Chegg Com

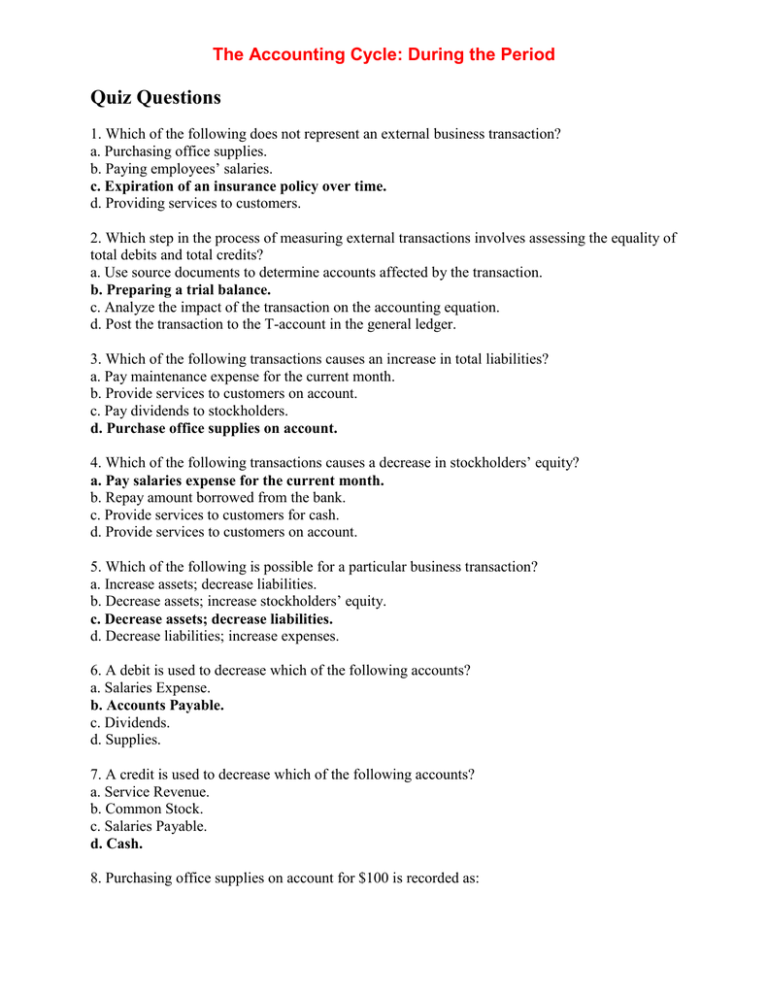

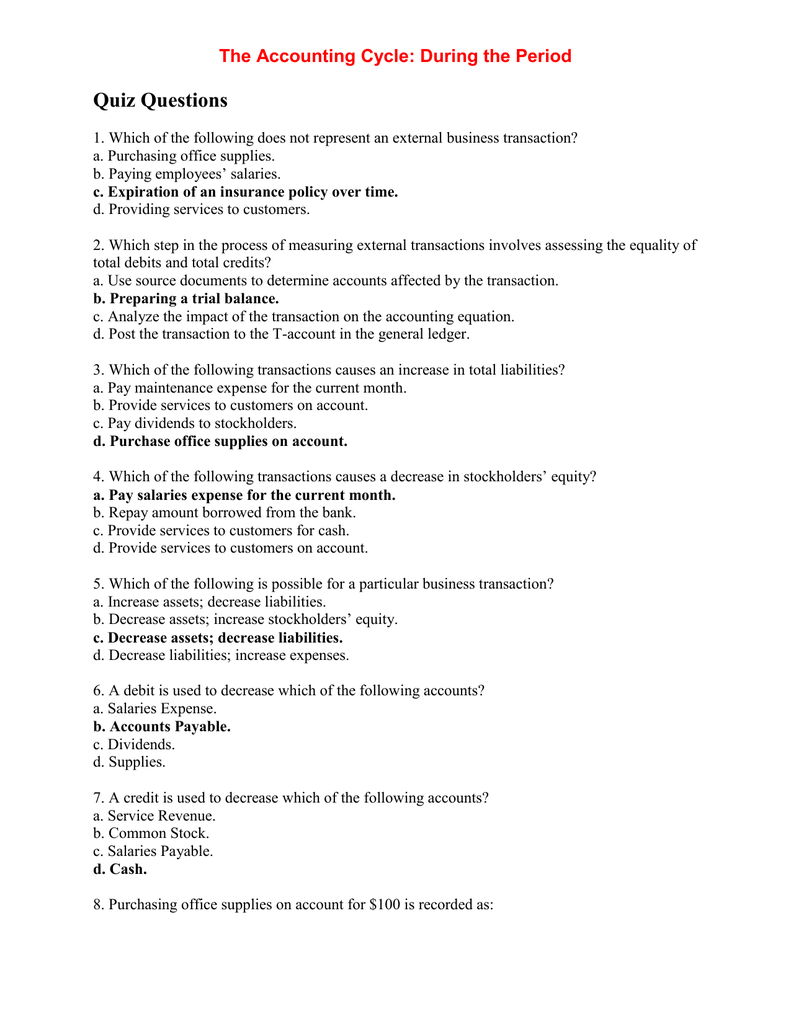

Quizzes Chapter 5 Books Of Accounts Double Entry System Pdf Debits And Credits Financial Transaction

Solutions Financial Acc Chapter 3

Solved Name Acc 101 Lab Spring 2021 Lab Assignment 2 6 Chegg Com

Answered 4 To Decrease The Balance In The Bartleby

Quizzes Chapter 5 Books Of Accounts Double Entry System Pdf Debits And Credits Financial Transaction

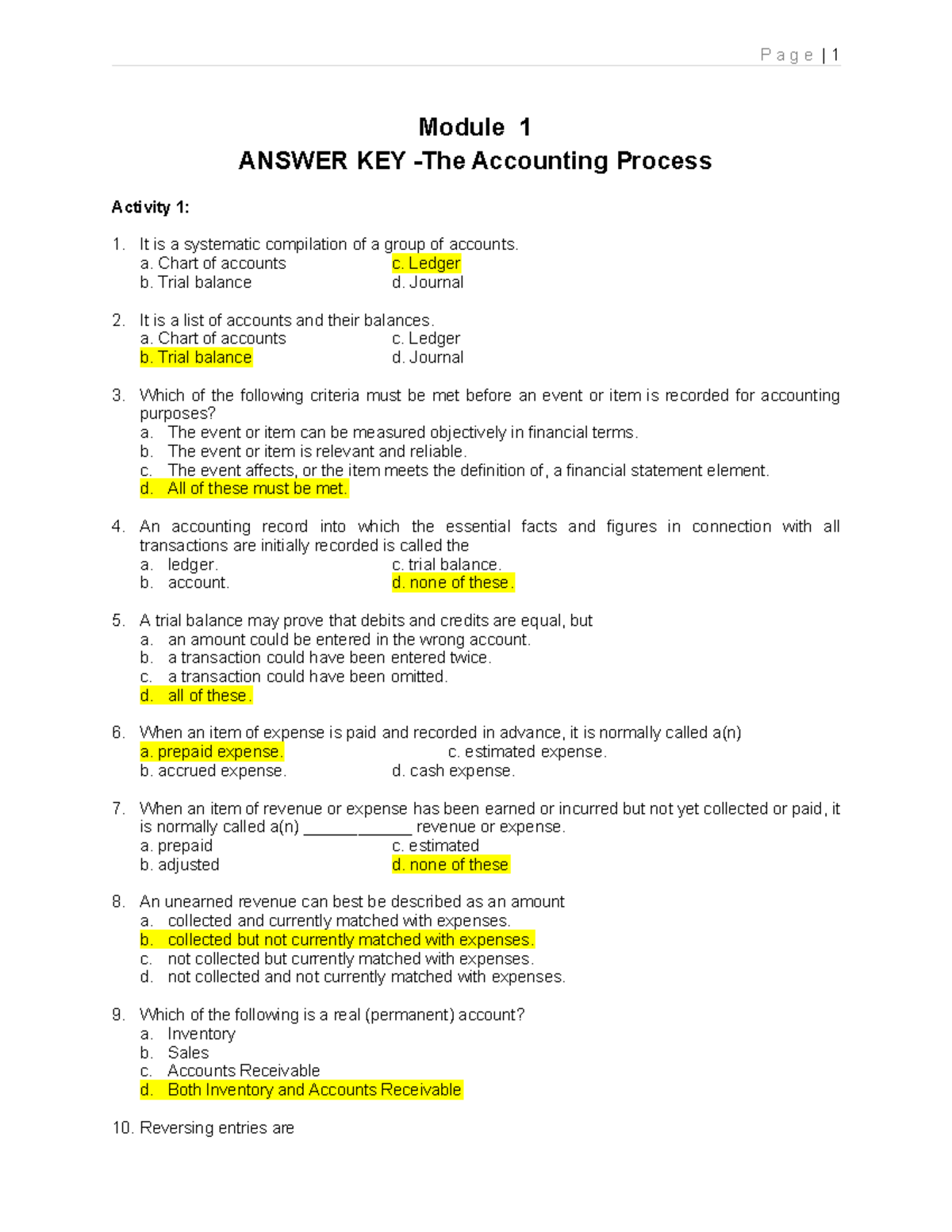

Answer Key Accounting Process Module 1 Answer Key The Accounting Process Activity 1 It Is A Studocu

On Which Side Will Be The Increase In The Following Accounts Recorded Also Mention The Nature Of The Account Sarthaks Econnect Largest Online Education Community

Solved Question 1 2 Pts Which Of The Following Accounts Are Chegg Com

Quiz 1 13 On Tập Trắc Nghiệm Accounting 3301 Studocu

Chapter 2 Accounting For Transactions

Question 4 1 Pts Assume You Needed To Record Journal Chegg Com

Accounting Principles 12th Edition Ch2

Doc Chapter Emiaj Mendoza Academia Edu

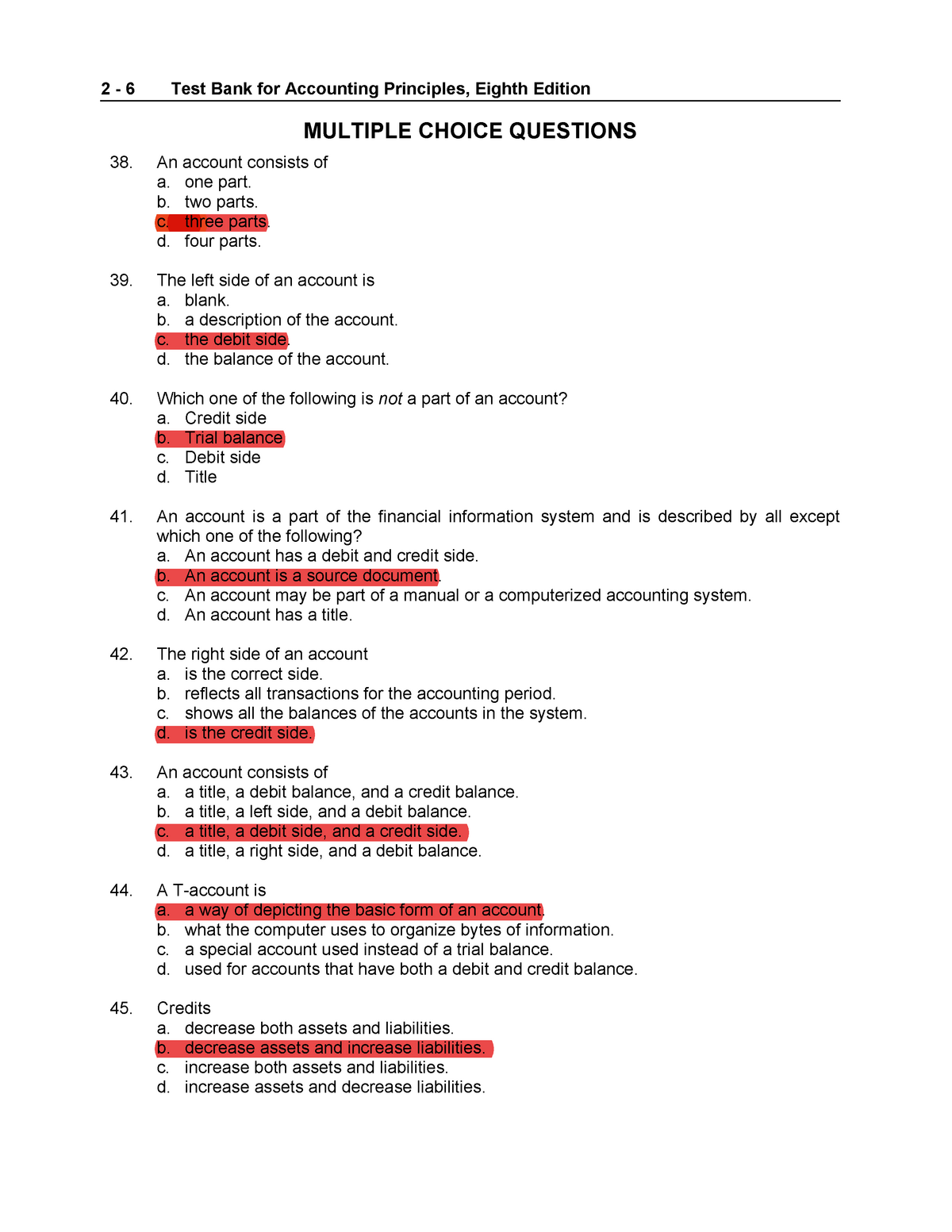

Chap2 Mcqs Test Bank For Accounting Principles Eighth Edition 2 6 Multiple Choice Questions Studocu

Hw Part 2 For Week 4 Principles Of Accounting Acct102 University Studocu

Comments

Post a Comment